In lending, effective document management is crucial for ensuring compliance, streamlining operations, and providing exceptional customer service. With the advent of cloud-based loan origination software solutions like Liquid Logics, lenders can access advanced tools and capabilities to revolutionize document management processes. In this comprehensive guide, we’ll delve into the best practices for document management in lending and explore how lenders can leverage technology to optimize efficiency, accuracy, and security.

Importance of Document Management in Lending

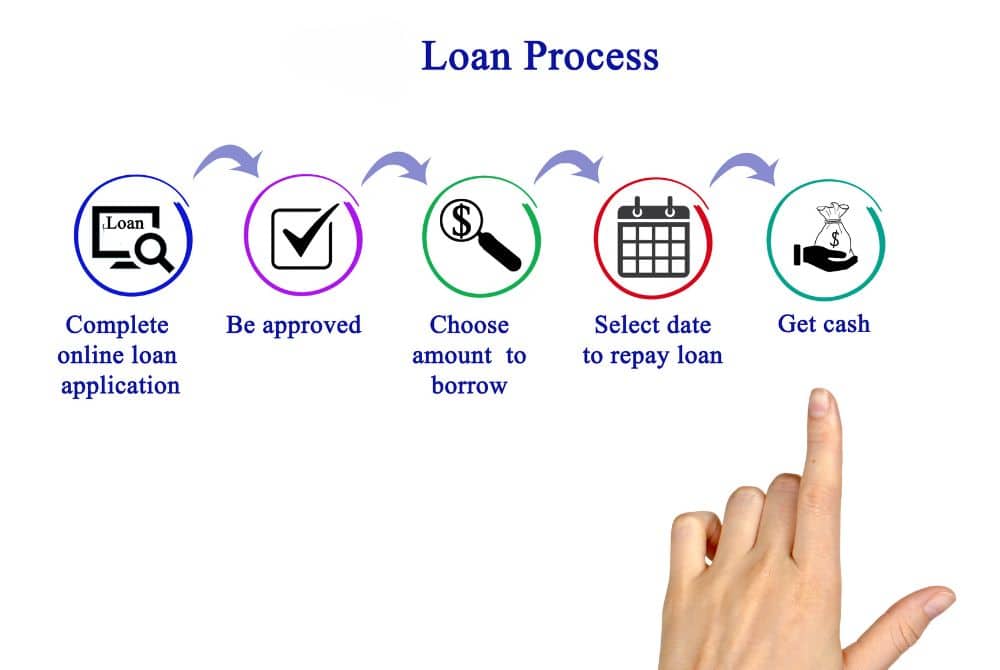

Document management plays a pivotal role in every stage of the lending process, from application and underwriting to closing and servicing. Proper document management ensures that all required documents are collected, organized, and securely stored, reducing the risk of errors, delays, and compliance violations. In addition, efficient document management enhances transparency, collaboration, and customer satisfaction, ultimately contributing to the success and profitability of lending operations.

Best Practices for Document Management

Digitize Documents

Embrace digital transformation by digitizing paper documents and transitioning to electronic document management systems. Digital documents are easier to access, share, and store, eliminating the need for physical storage space and minimizing the likelihood of loss or damage.

Centralized Document Repository

Establish a centralized document repository within your loan origination software platform, such as Liquid Logics, to store all loan-related documents in a secure and organized manner. A centralized repository streamlines document access, retrieval, and management, enabling efficient collaboration and decision-making.

Automated Document Collection

Implement automated document collection processes to streamline the gathering of borrower documentation. Leverage digital portals and automated workflows to request and collect required documents from borrowers, reducing manual effort and improving efficiency.

Document Checklist Templates

Develop standardized document checklist templates for each loan product or program to ensure consistency and completeness in document collection. Document checklists serve as a guide for borrowers and loan officers, outlining the specific documents needed for each loan application.

Document Imaging and OCR Technology

Utilize document imaging and optical character recognition (OCR) technology to capture and extract data from scanned documents. OCR technology automatically converts scanned documents into searchable and editable text, enhancing data accuracy and reducing manual data entry errors.

Version Control

Implement version control mechanisms to track document revisions, updates, and approvals throughout the lending process. Version control ensures that all stakeholders can access the latest document versions and reduces the risk of using outdated or incorrect information.

Document Security and Compliance

Prioritize document security and compliance by implementing robust access controls, encryption, and audit trails within your document management system. Ensure that sensitive borrower information is protected against unauthorized access or disclosure and that all document management practices comply with regulatory requirements.

Document Retention Policies

Establish document retention policies to govern the storage and disposal of loan-related documents in accordance with legal and regulatory requirements. Define retention periods for different document types based on their importance, relevance, and compliance obligations.

Leveraging Technology for Document Management

- Cloud-Based Document Management: Leverage cloud-based document management solutions, such as Liquid Logics, to centralize document storage, access, and collaboration. Cloud-based platforms offer scalability, flexibility, and accessibility, allowing lenders to securely manage documents from anywhere at any time.

- Integration with Third-Party Systems: Integrate your document management system with third-party platforms and data sources to streamline document exchange and processing. Seamless integration enables data synchronization, eliminates duplicate data entry, and enhances interoperability between systems.

- Advanced Analytics and Reporting: Harness the power of advanced analytics and reporting tools within your document management system to gain insights into document-related metrics, such as document completion rates, turnaround times, and compliance adherence. Analyze trends and patterns to pinpoint opportunities for enhancing process improvement and optimization.

Wrapping Up Best Practices for Document Management

Effective document management is essential for success in the lending industry, enabling lenders to streamline operations, enhance compliance, and deliver superior customer experiences. By following best practices for document management and leveraging technology solutions like Liquid Logics, lenders can optimize efficiency, accuracy, and security throughout the lending process. At Liquid Logics, we are committed to providing best-in-class cloud-based loan management software solutions that empower lenders to achieve excellence in document management and lending operations. Contact us today to learn more about how we can support your document management needs and drive success in lending.